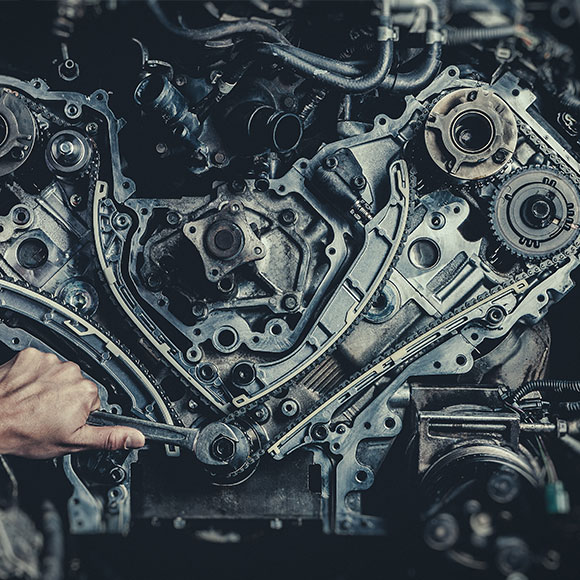

Every motor trade business is unique, whether in what it does, its size, the materials and tools it uses, and even its location.

From part-time motor traders who work from home to larger enterprises with many employees, a solid motor trade policy means building it based on specific needs.

You could buy and sell vehicles, be a certified repairer or MOT test centre, deal with modifications, sell tyres and other parts, or work as a paint or body shop.

Whatever you may be, a basic motor trade insurance policy probably won’t protect you the way you need it and you could be paying for features that don’t apply to you.

You need insurance that is based on your specific requirements, which is where our team come in.

At Insure 313, we will aim to quickly grasp what your business does, and the risks associated with it. These could be as diverse from equipment damaging a customer’s vehicle, tools becoming lost or stolen, injury to an employee due to your negligence or weather conditions damaging your contents or buildings.

Some of these could be avoided while others are beyond your control. Either way, a strong insurance policy can place you in an excellent position to recover no matter what happens.

Key Features

A Motor Trade policy can include;

- Business premises and assets

- Public and product liability

- Employers’ liability

- Road risks

- Equipment and tools

- Servicing and sale of goods

- 24/7 claims service

This list is not exhaustive. We have access to some of the leading insurers and can tailor a policy specifically to your requirements.

For more information, fill in the form below.